Published by: CA Manish Harchandani

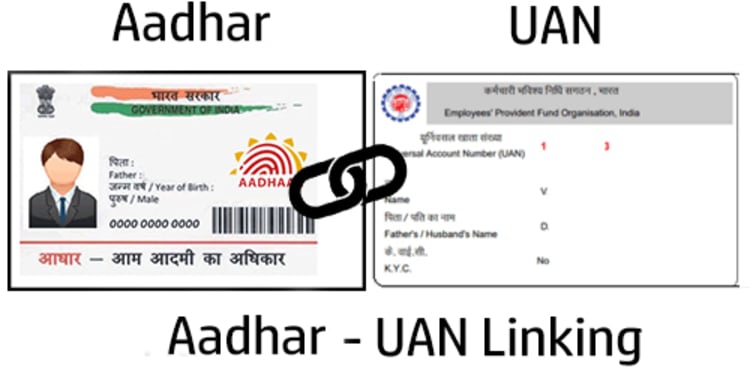

Due date for seeding of AADHAAR with UAN extended

On 15th November, 2021 the Government extended the due date of linking of UAN with AADHAAR to 01-Dec-2021.

The relevant cirulcar is as under:

Tags: ESICUANAADHAAR

[ Published on: 15-11-2021 ]

SIMILAR ARTICLES

www.harchandani.in|+91 9909 880 111|harchandanica@gmail.com

This article is published for informational purposes only and does not constitute legal, financial, or professional advice. © 2026 Harchandani & Associates. All rights reserved.

Terms of Use | Privacy Policy | Disclaimer

© 2026 Harchandani & Associates, All rights reserved.

Design & Developed by Pravin Harchandani

© 2026 Harchandani & Associates, All rights reserved.

Design & Developed by Pravin Harchandani